MGARCH & Copulas — Multivariate Volatility and Dependence in R

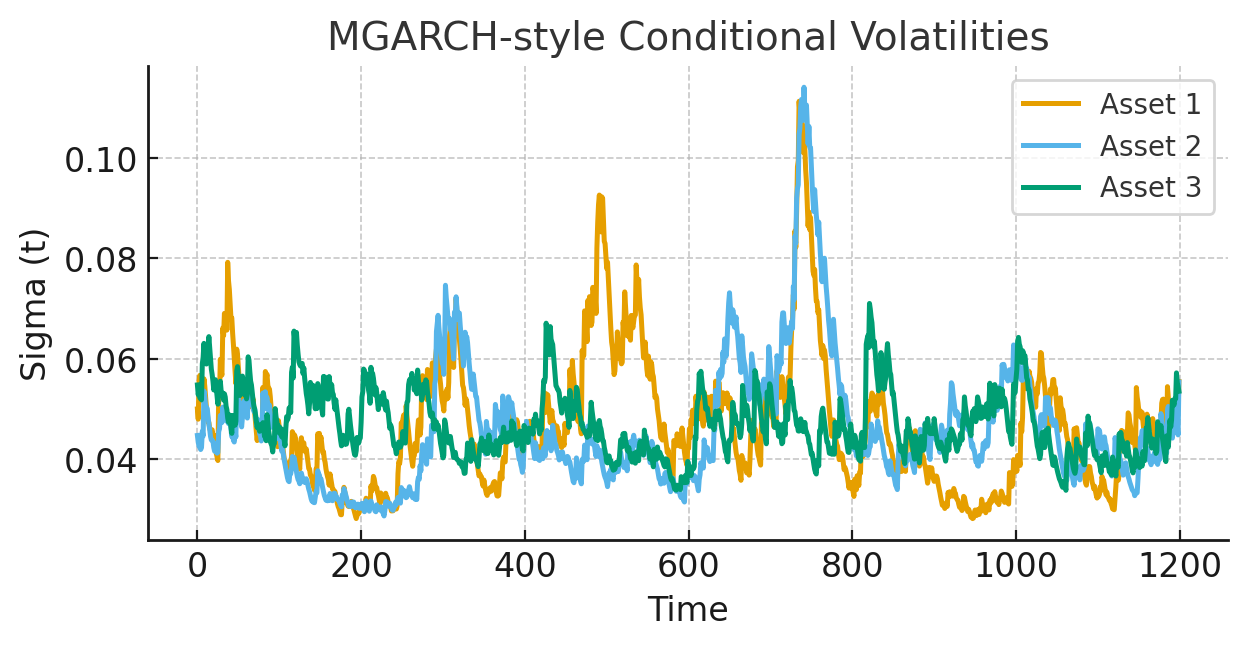

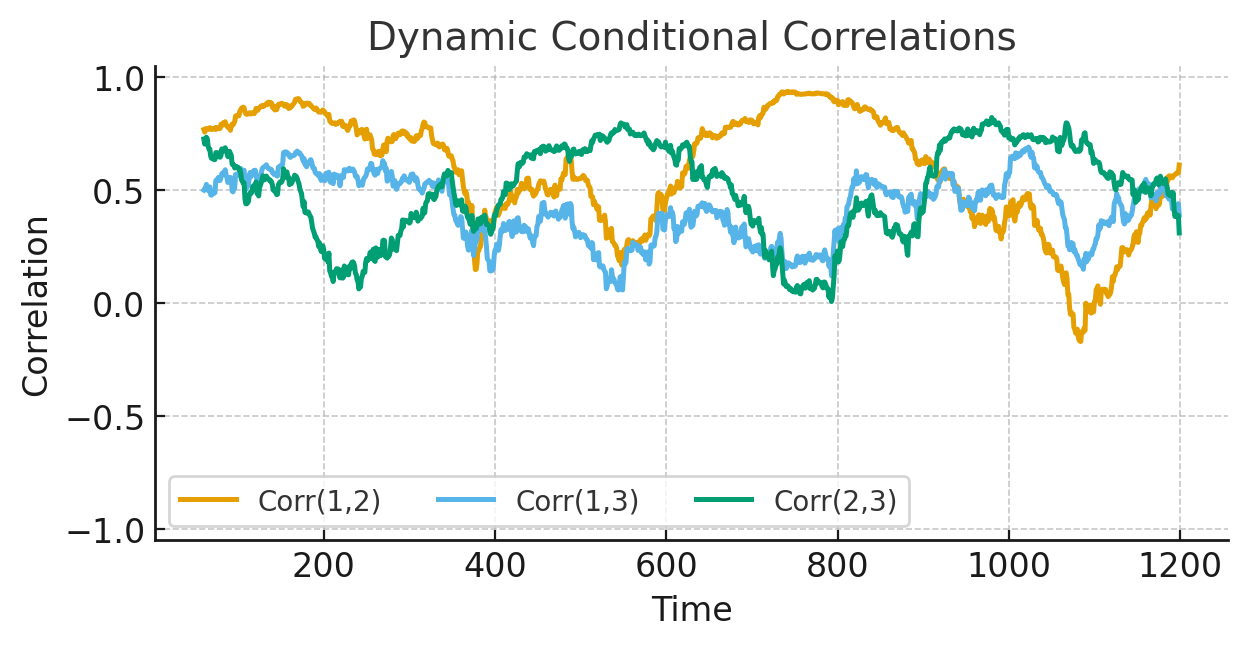

I develop end-to-end workflows for multivariate volatility modelling and dependence modelling in R. On the volatility side, I implement MGARCH families: CCC, DCC (standard, corrected, asymmetric ADCC), BEKK (diagonal/full), DVEC, OGARCH / GO-GARCH, with conditional distributions such as Gaussian, Student-t, and skew-t. I provide rolling/expanding forecasts for portfolio volatility, conditional correlations, and risk metrics.

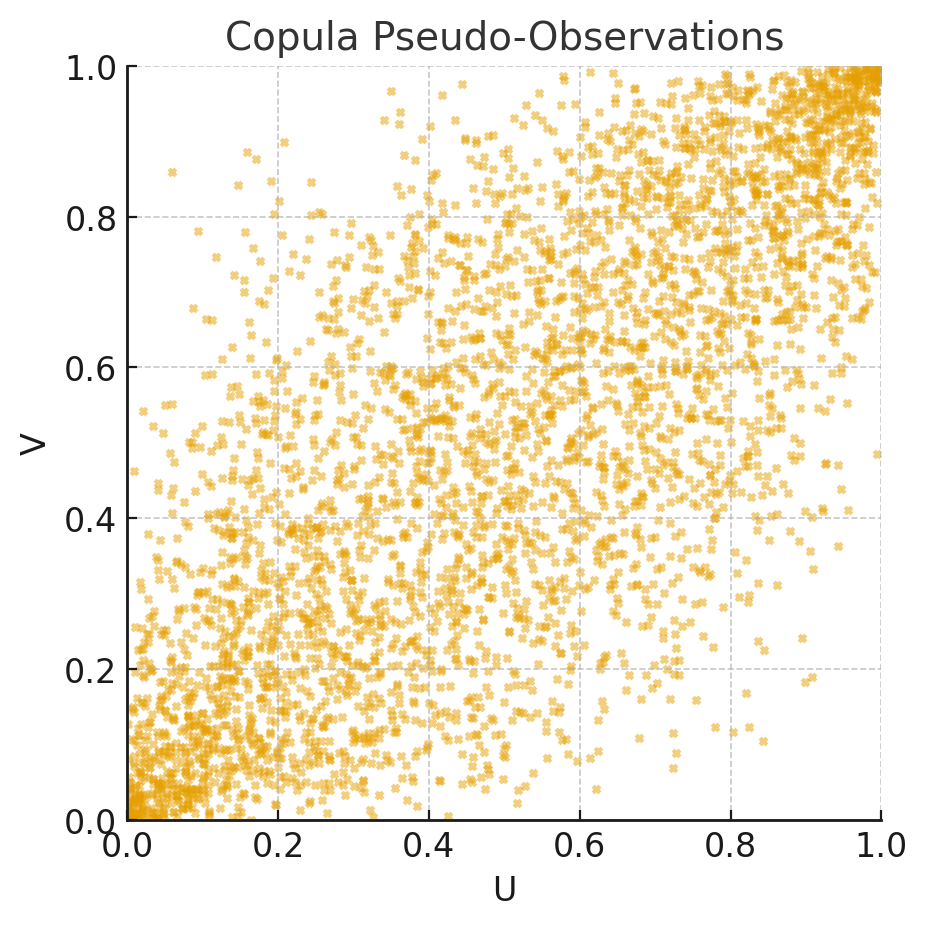

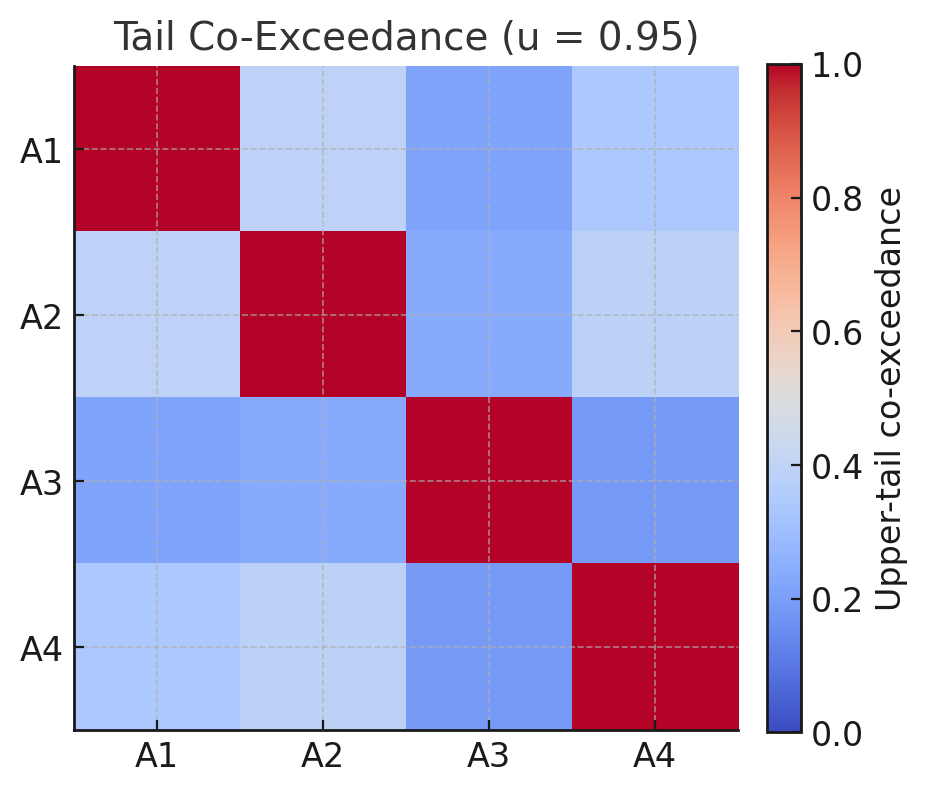

For dependence, I build copula models on standardized residuals or filtered returns: elliptical copulas (Gaussian, t) and Archimedean (Clayton, Gumbel, Frank, Joe) as well as BB families, with vine copulas (C-vine / R-vine) for higher dimensions. I use IFM/CML estimation, PIT/Rosenblatt diagnostics, information criteria (AIC/BIC), and tail-focused checks (upper/lower tail co-exceedances, tail-dependence summaries). Where relevant, I compare copula-based dependence with MGARCH-implied correlation dynamics.

Risk & validation: VaR/ES backtesting (Kupiec, Christoffersen), hit rates and exception clustering, joint tail exceedances, stress-testing scenarios, and portfolio-level implications. I also report parameter significance, stability, Engle–Sheppard correlation tests, and out-of-sample forecast accuracy. Deliverables include clean R scripts (rugarch, rmgarch, copula, VineCopula), publication-quality figures, and a concise memo for inclusion in reports or theses.

I am very familiar with these methods and can provide hands-on R programming help for coursework, projects, and research. Engagements start at USD $150; fixed quotes follow a short review of your brief and data.