GARCH & DCC-GARCH — Volatility and Dynamic Correlation Modelling in R

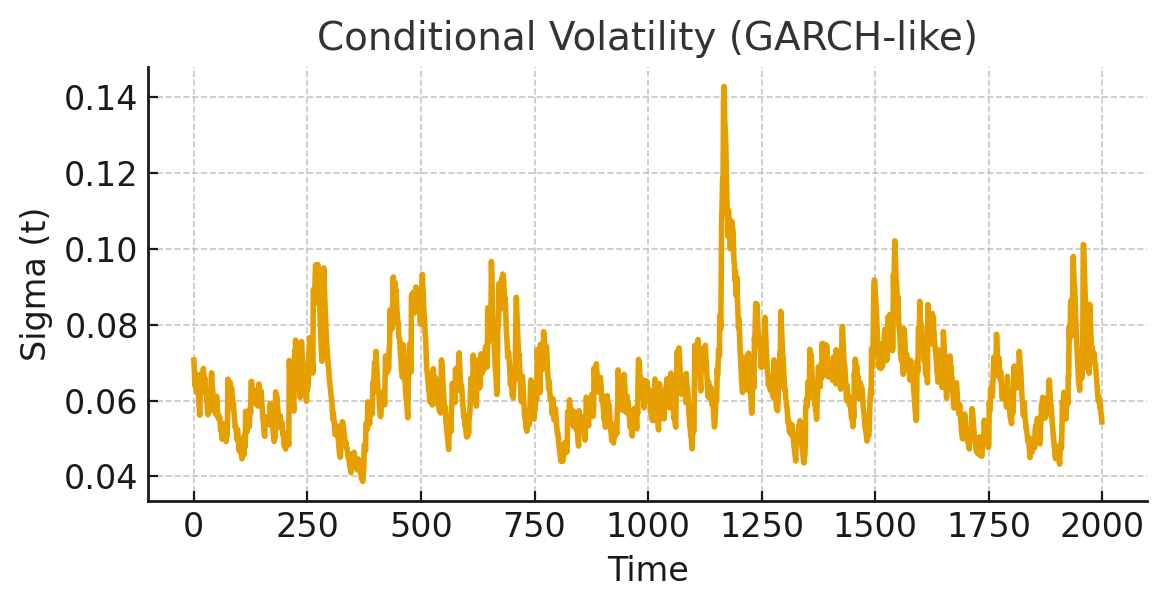

I provide end-to-end pipelines for univariate and multivariate volatility modelling in R. For individual assets, the baseline GARCH(1,1) is complemented with families that capture practical features of returns: EGARCH for log-variance dynamics, GJR-GARCH for leverage/asymmetry, and APARCH for flexible power terms. I configure conditional distributions (Gaussian, Student-t, skewed-t) and run rolling or expanding forecasts to produce horizon-aligned volatility estimates and prediction intervals.

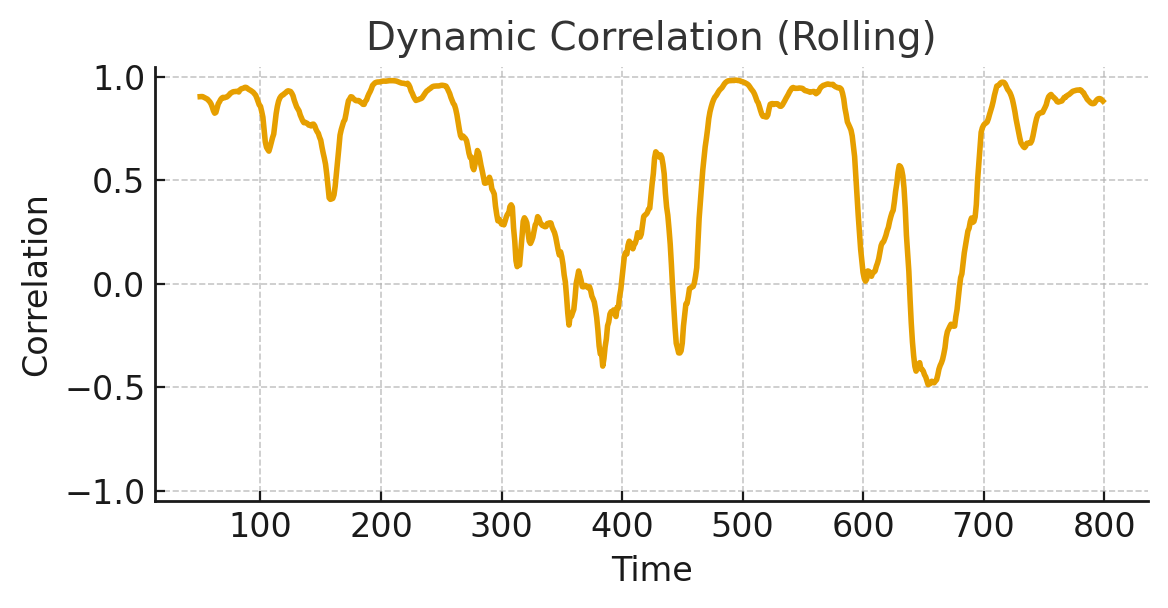

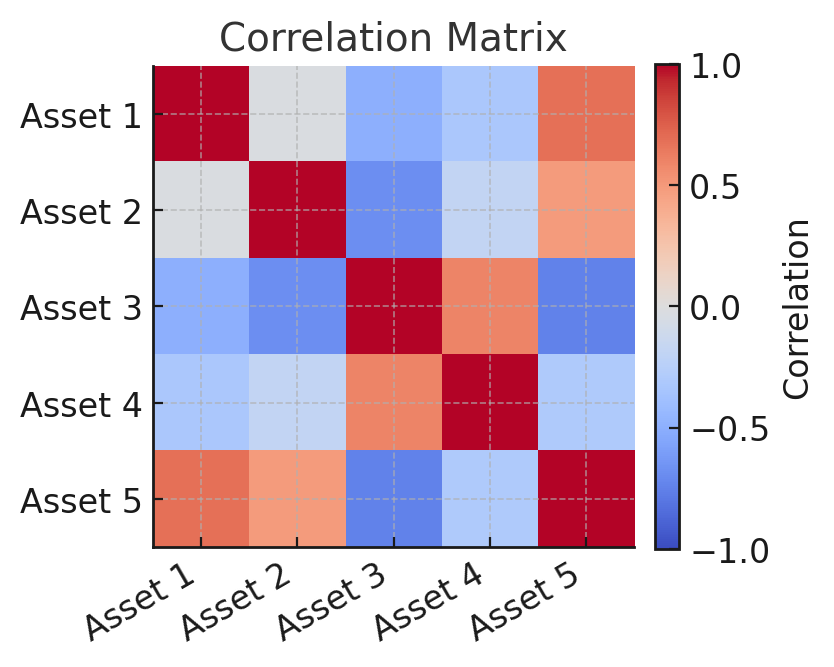

For multi-asset problems, I implement DCC-GARCH variants (DCC, cDCC, ADCC) to obtain time-varying conditional correlations from standardized residuals. Depending on the brief, I can also compare with CCC, BEKK, or copula-based dependence and deliver portfolio-level risk metrics and diversification diagnostics driven by dynamic correlation structure.

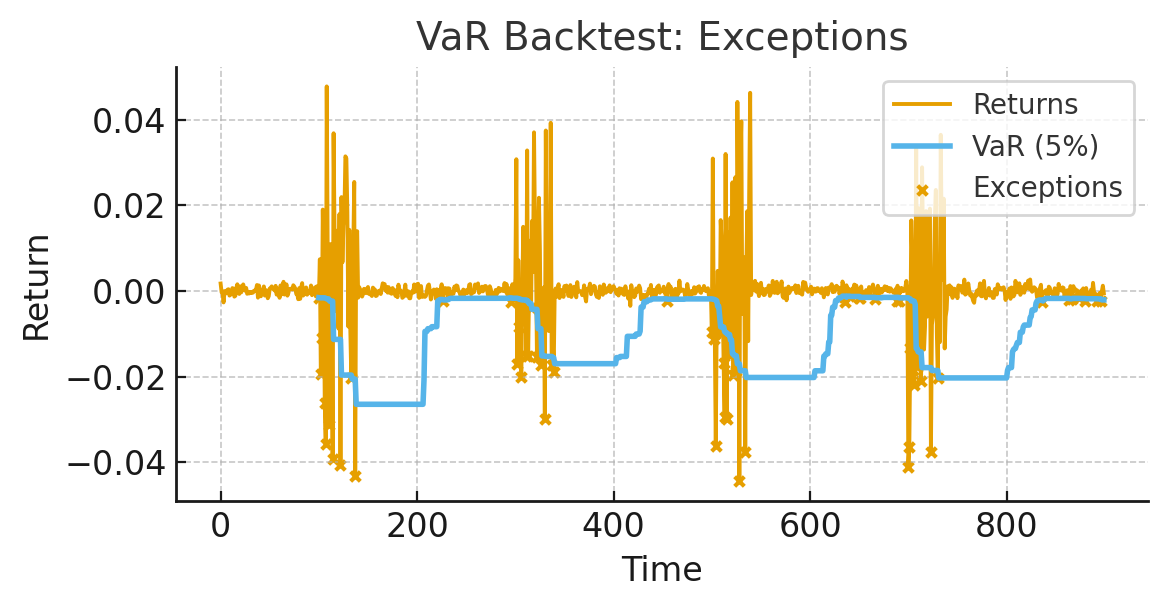

Diagnostics are first-class: information criteria for model selection, residual and squared-residual portmanteau tests, ARCH-LM checks, stability/parameter significance, and forecast evaluation with rolling backtests. For risk, I include VaR/ES backtesting (e.g., Kupiec and Christoffersen) and exception analysis, with concise figures suitable for reports and theses.

Deliverables: clean and reproducible R scripts (rugarch/rmgarch), well-annotated figures, and a short memo describing specification choices, diagnostics, and interpretation. Engagements are billed at a minimum of USD $150, with fixed quotes after I review your brief and data.