CAPM, FF3, FF5, Efficient Market Evaluation, GRS Test, Factor Analysis, Event Study

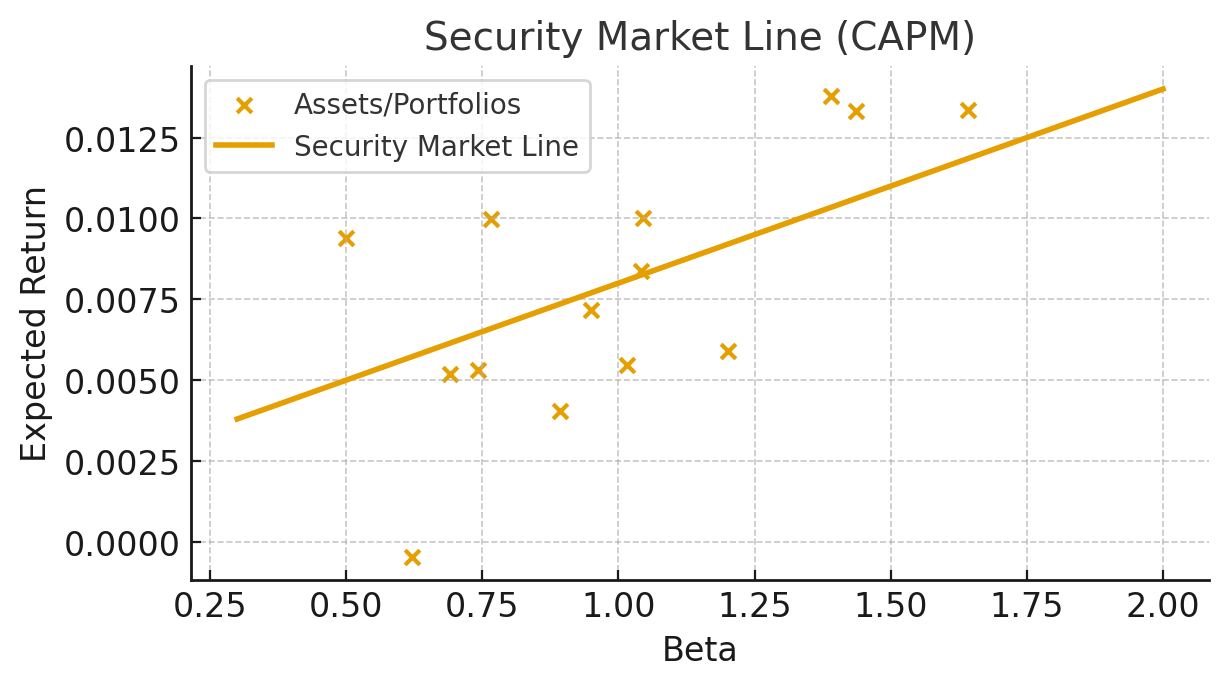

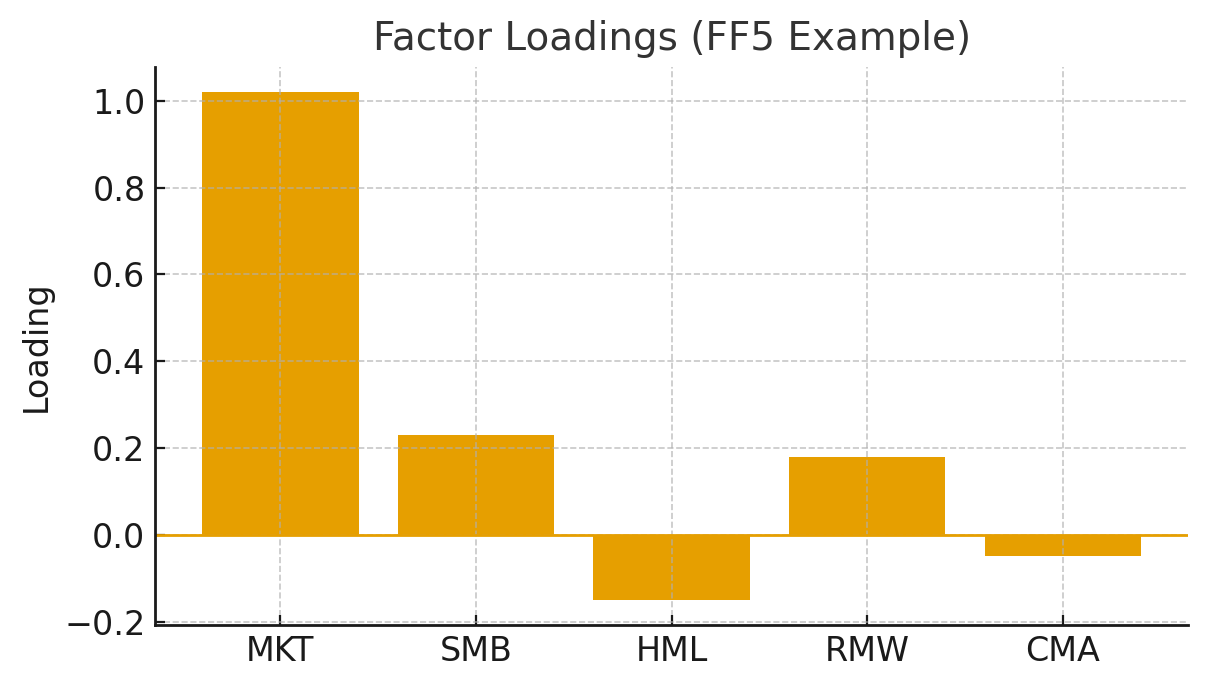

I build empirical asset-pricing and event-study pipelines in R, from data ingestion and cleaning to inference and publication-ready figures. For cross-sections and test assets, I implement time-series regressions (CAPM, Fama–French 3-/5-factor, momentum, quality/profitability), and Fama–MacBeth (two-pass) for risk premia. I also support conditional models with instruments, rolling windows, and small-sample-robust inference.

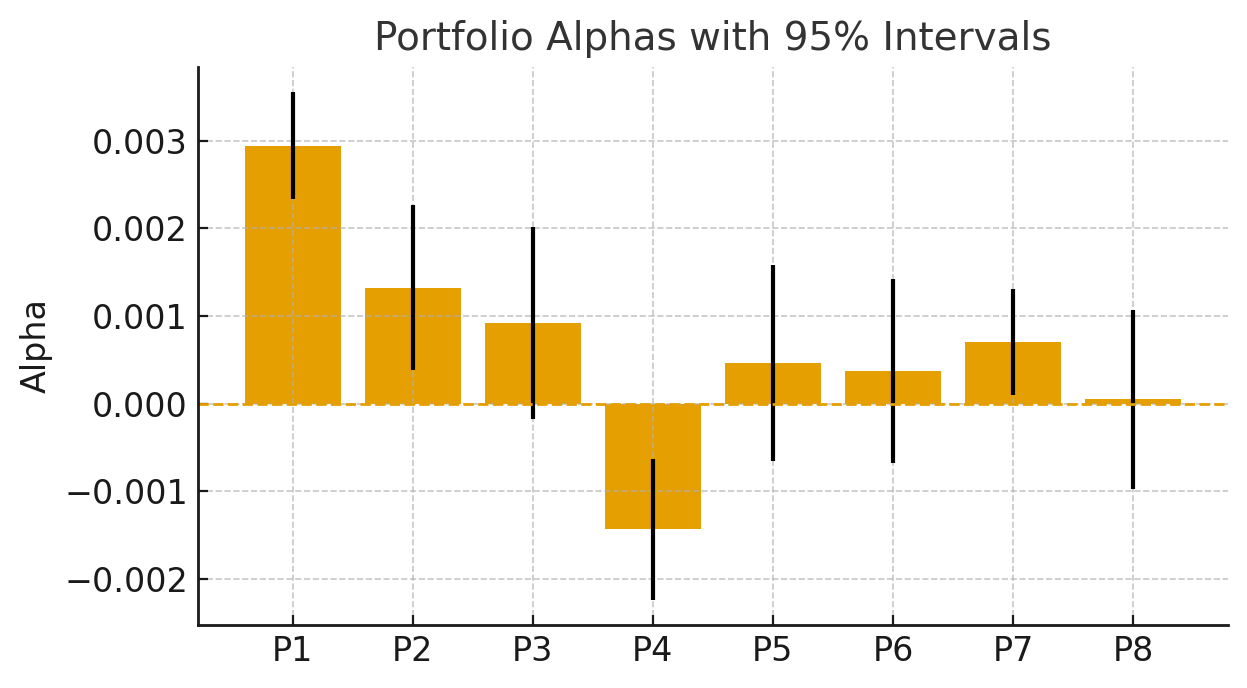

Asset-pricing toolkit: factor construction/merging (e.g., MKT, SMB, HML, RMW, CMA; momentum), portfolio sorts (quantile/decile, 2×3 grids), factor loadings, alpha tests, and GRS joint alpha testing across multiple portfolios. I report alphas, t-stats, confidence intervals, intercept joint tests, and model-comparison tables (AIC/BIC, adj. R², pricing errors).

Efficient market evaluation: pricing error diagnostics (alphas near zero), spanning tests, alternative factor sets, out-of-sample checks, and stability across subsamples. Where appropriate, I add shrinkage/Bayesian variants and principal-components factor analysis (e.g., PCA) to reduce dimensionality or extract latent risk drivers.

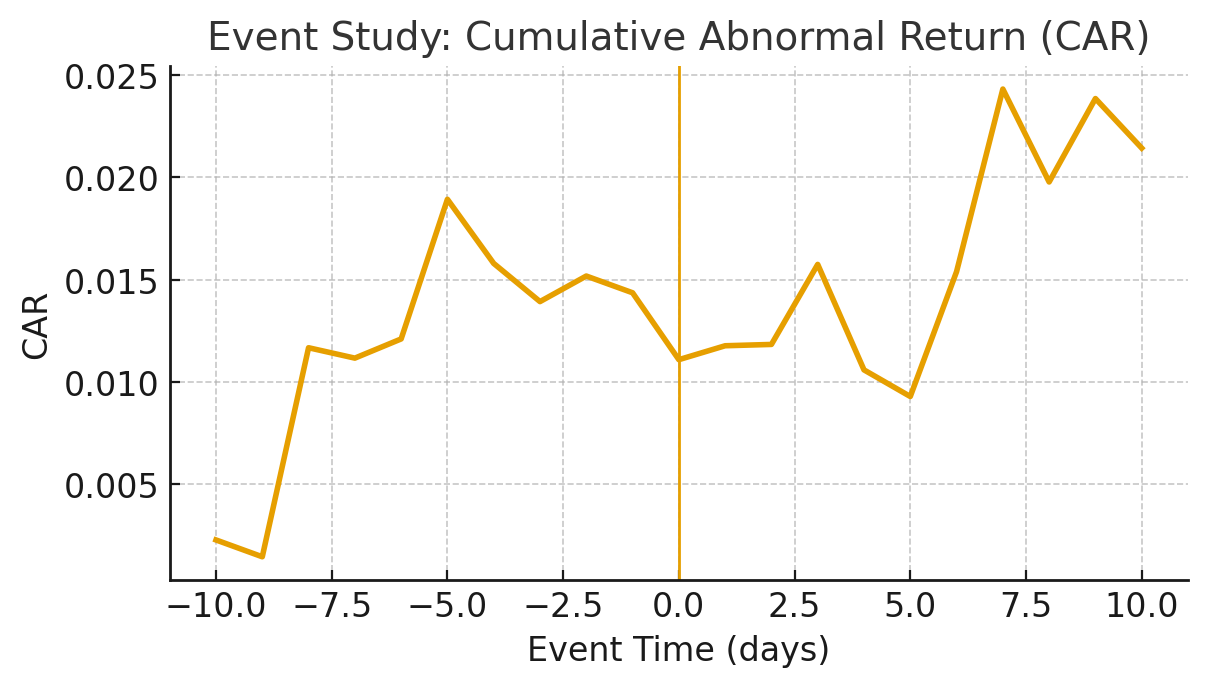

Event study: single and multiple events with clean windows and aggregation: AAR/CAAR/CAR, parametric/nonparametric tests, clustering/multiple-testing control, and industry/market adjustments. Deliverables include tidy R scripts, reproducible tables, and figures ready for reports or theses.

I’m very familiar with these methods and can provide hands-on R programming help end-to-end—data handling, modelling, diagnostics, and interpretation—tailored to coursework, projects, and research.

Get help: engagements start at USD $150; fixed quotes follow a brief review of your data and scope.