MIDAS, GARCH-MIDAS, MIDAS Regression — Mixed-Frequency Modelling in R

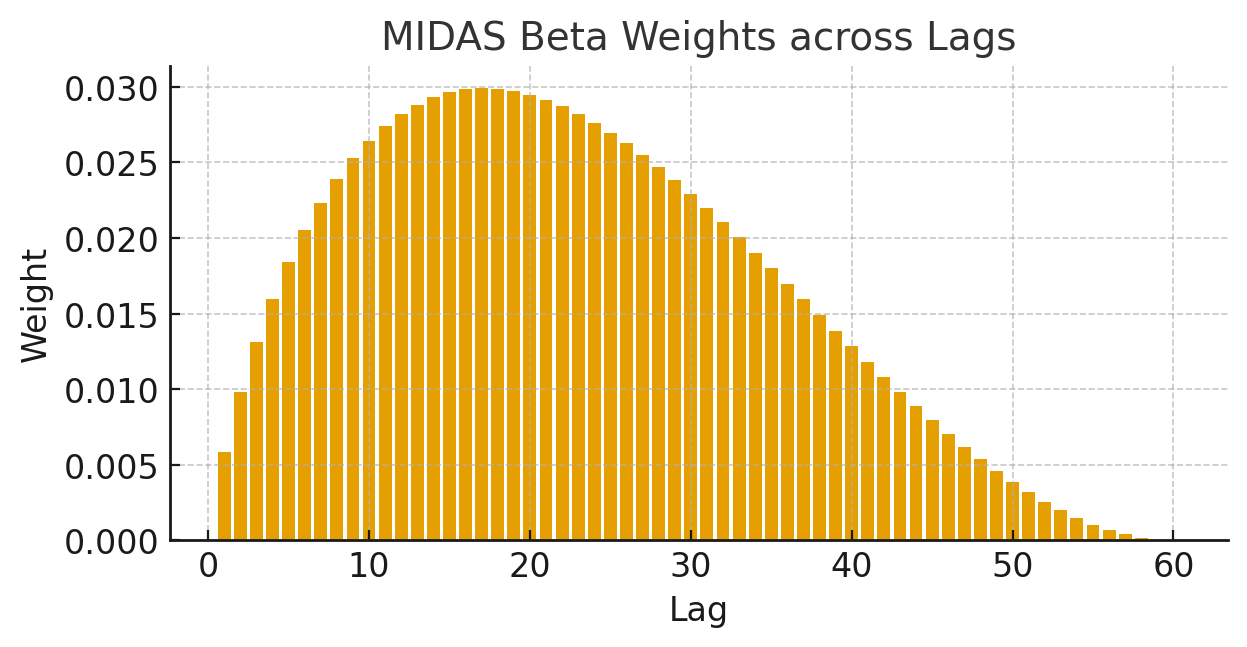

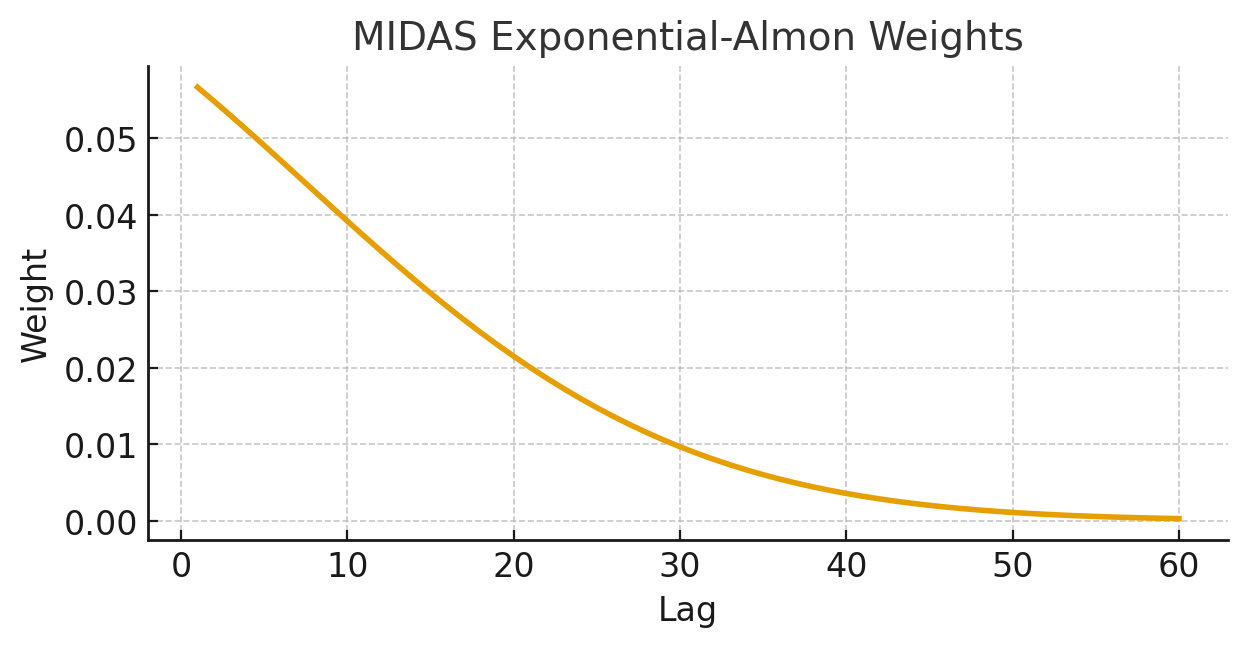

I design and implement MIDAS pipelines in R to link low-frequency targets (e.g., monthly GDP, quarterly inflation) with high-frequency predictors (daily/weekly financials, Google Trends, realized measures). I’m familiar with restricted MIDAS (parametric lag polynomials) and U-MIDAS (unrestricted), using Beta, E-Almon, or other weighting schemes to compress dozens of high-frequency lags into a few interpretable parameters.

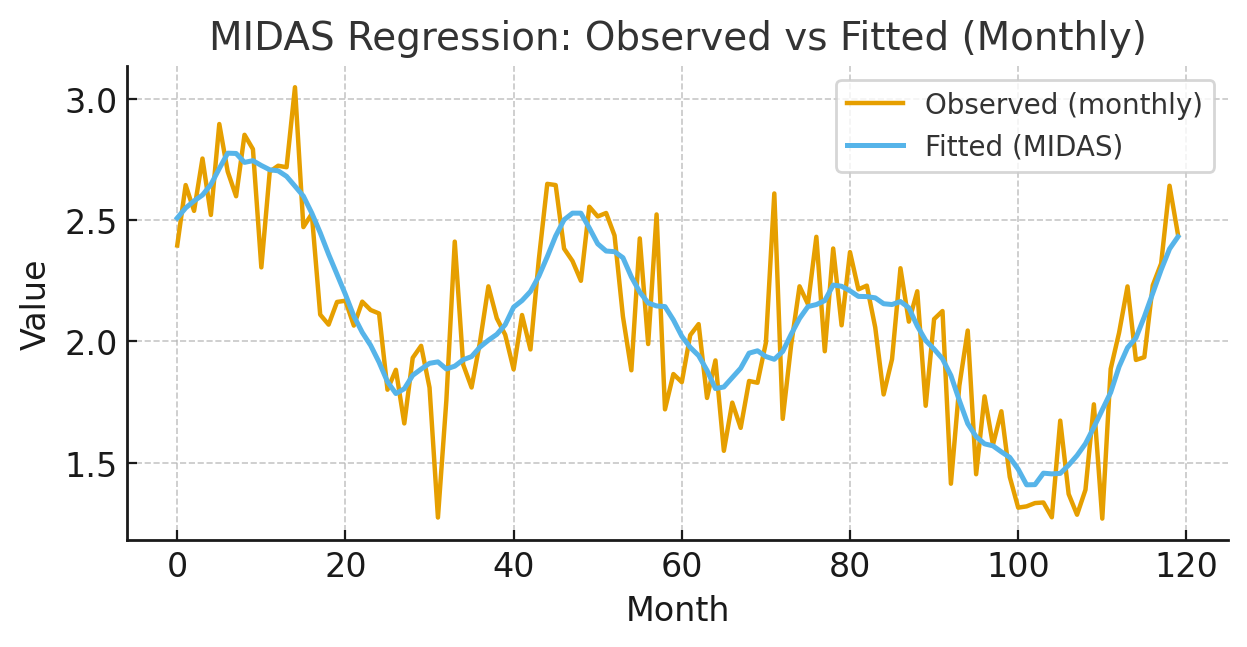

Core methods: MIDAS regression (OLS/NLS), AR-MIDAS (autoregressive terms on the dependent), ARIMAX-MIDAS / SARIMAX-MIDAS for seasonality, Factor-MIDAS (principal components from many predictors), rolling/expanding forecasting, multi-horizon evaluation, and out-of-sample model comparison. I handle frequency alignment, ragged edges, calendar effects/holidays, transformations (Box-Cox/log), and robust inference (HAC/Newey-West where appropriate).

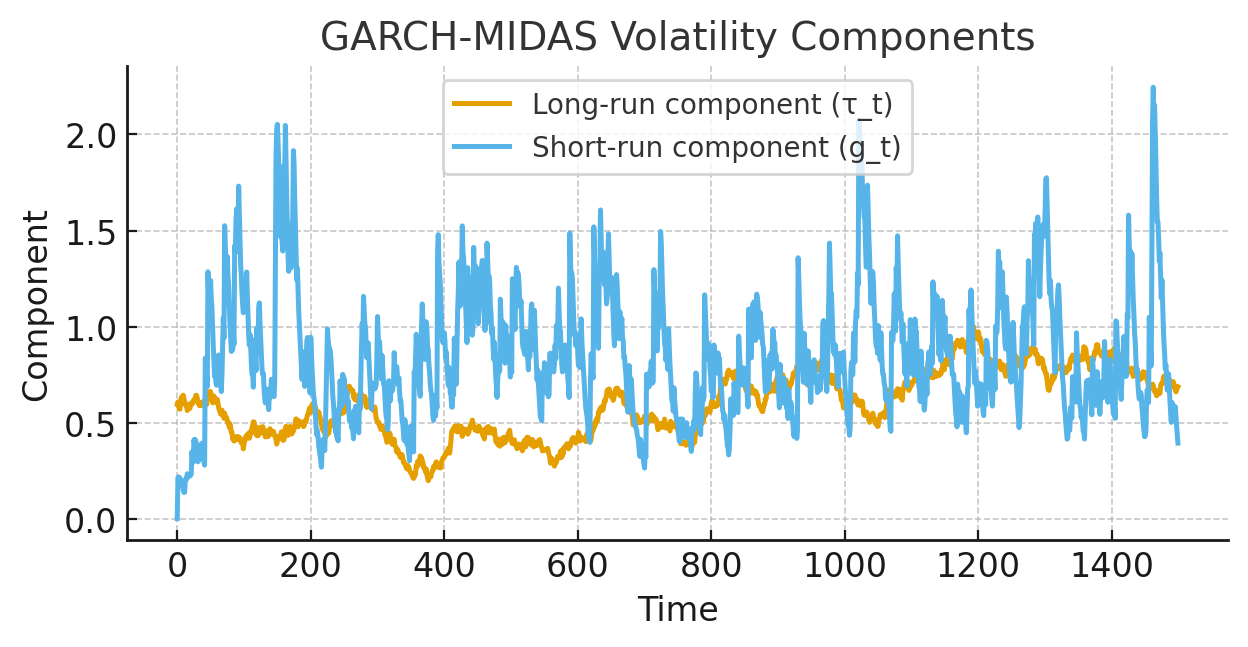

GARCH-MIDAS: decomposition of volatility into a high-frequency short-run component and a low-frequency long-run component driven by macro or realized measures; rolling forecasts of conditional variance and applications to risk metrics. I can benchmark against alternatives (ARIMA/ETS, simple distributed lags) and run Diebold–Mariano tests for forecast dominance.

Diagnostics & reporting: AIC/BIC selection, residual checks, stability and parameter significance, cross-validation, and forecast tables with calibrated intervals. Deliverables include clean R scripts (e.g., midasr and companion code), publication-ready figures, and a short memo with interpretation you can insert in reports or theses. I’m very familiar with these methods and provide hands-on R programming help for coursework, projects, and research.

Get help: engagements start at USD $150; fixed quotes follow a quick review of your brief and data.